It is not an easy task managing money. After all, the education system in many ways neglects to teach children early on how to be smart with money. Unless you graduated college with a business, economics, or accounting degree, money may still be something you are uncertain about. My goal is to provide some quick options for you to consider. Investing is the greatest tool at your disposal that can help build wealth and financial stability. Responsible money management early on in life will carry forward for years to come. I believe every Marine Officer must be competent when it comes to finances. Not simply because it will benefit themselves, but more so the Marines under their guidance.

Stocks

Owning a share of stock represents a proportional share of ownership in a company. The price of a stock changes depending on the value of the company. Companies with huge growth potential are more likely to have an increase in stock price. Other companies with less growth potential will pay out a dividend. In those cases, you will receive a portion of the companies earnings based on how much stock you own. Historically, stocks have had the most upside compared to other investments. I personally favor stock investments over mutual funds, bonds, CDs, etc. However, it is important to weigh in your ability to manage stocks. For instance, if you aren’t going to be able to watch the market for weeks at a time then stocks may not be the best option. It doesn’t take a huge amount of time to manage stocks, but at least a few hours a week is going to be necessary.

Mutual Funds

Buying into a mutual fund is similar to owning stocks. The main difference is the fund manager will be choosing what stocks to buy and sell. Essentially, you are throwing your money into a pool that the managers can use to invest. If the mutual fund does well you will be rewarded, if not you are out of luck. I’m not a huge fan of mutual funds because there are many managers that underperform the market indexes. If the fund doesn’t do well the money you invested is lost, but the money managers are still profiting off of the commissions you pay them. If this is the vehicle you choose to put your money in, I suggest doing research just as would do for stocks. Make sure the fund handling your money is reliable and has a proven track record of making investors money.

Exchange-Traded Funds (ETFs)

An ETF is a fund that trades similarly to stocks. These vehicles for investing may contains hundreds, or even thousands of companies, commodities, or bonds that are unified by a specific theme. For instance, one may choose to buy in ETF that tracks companies in the solar energy industry, or perhaps 3D printing companies. There is an ETF for just about anything (bonds, countries, market sectors, etc.). There are definitely various pros and cons to investing an ETFs. If you are interested I would suggest learning all you can and researching extensively.

I truly believe that it is critical for Marine Officers to teach financial responsibility to their Marines. There are dozens of ways to invest money. The important things to remember is to always do plenty of research beforehand. It was not easy earning the money you have saved up so don’t give it up too hastily.

I would definitely encourage you to have your Marines invest everything they can afford in the Roth TSP and Roth IRA. The tax advantages gained from these two retirement accounts is phenomenal. Also, make sure that they maximize their Savings Deposit Program (SDP) contributions when they deploy. A guaranteed 10% annual return on up to $1000. That’s a no-brainer.

Thanks Spencer! I’m just getting this site started up and I will be sure to do a nice write up about other investment options.

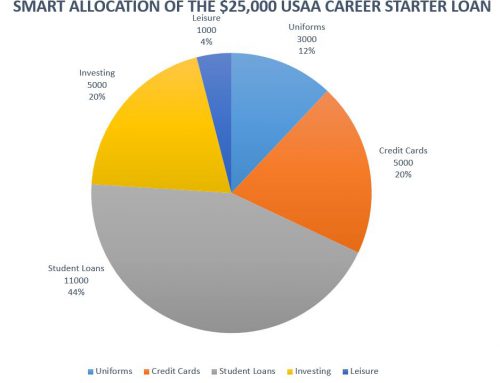

Great website, and as a new 2nd LT waiting on TBS there’s a lot of good information. Something I’ve been considering is the career starter loan from USAA, which I’ve heard is a very investable sum of cheap money. What are your thoughts on that?

Thanks.

The loan is great if you use the money smartly. A lot of your peers will end up buying new cars which is a horrible way to start a career. Using it to pay off high interest credit card debt or student loans is great. Investing a portion would also be smart. Lastly, keep a solid chunk of it stashed away for making payments during the first few months before pay kicks in. The payments are quite substantial and will significantly impact your monthly income over the next several years.

Hello USMC Officer….thank you for your service first of all. …my son has just completed OCS on an Aviation contact. He is currently waiting on his date to go to TBS which is October. He has 3 student loans that came due 6 months after graduating college which is during the time he is waiting for TBS and a paycheck. He knows that there will be certain financial needs at the onset of TBS, but not sure where to go for the best information regarding those needs. Also, are there any suggestions that you might have for him. I read here where you mentioned a Career Starter Loan and wondered if you could tell me how that works. Any other information that you could help us with would be highly appreciated. Thank you again.

USAA and Navy Federal offers up to $25,000 or $32,000, respectively, in low interest loans, 1 – 2 percent last time I checked. It’s a great way to balance yourself financially as you transition into a career as a Marine officer. However, I caution all young graduates not to utilize those funds for large personal expenses (e.g., a new car). Please contact USAA/Navy Federal for more information. It is an easy process and both banks are dedicated specifically to military personnel and their families.